Saudi Arabia’s Hyperlocal Delivery Market Poised for Rapid Growth Food Delivery Leads with 75% Share - Makreo Research

Food delivery dominates Saudi hyperlocal services with 75% share as rapid e-commerce growth, rural expansion, and tech-driven logistics fuel market momentum.

The surge in digital-first consumption and rapid fulfillment expectations is redefining how retailers and logistics players compete in Saudi Arabia’s evolving hyperlocal market.”

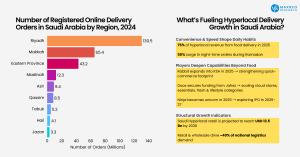

NAVI MUMBAI, MAHARASHTRA, INDIA, December 31, 2025 /EINPresswire.com/ -- Saudi Arabia’s hyperlocal delivery market is accelerating into its next phase of growth as consumer expectations shift toward convenience, rapid fulfillment, and digital-first shopping behaviors. According to a recent study by Makreo Research, the Kingdom’s hyperlocal delivery sector recorded a strong CAGR of 22.77% between 2021 and 2025, supported by booming online demand and greater investments from regional and global market players.— Omkar Manjrekar

Food delivery continues to dominate adoption trends, contributing over 75% of total hyperlocal market revenues in 2025. Ramadan remains a high-demand season where night-time order volumes surge by nearly 50%, driven by cultural consumption patterns and accelerated delivery services.

New Entrants and Investments Driving KSA Hyperlocal Competition -

Leading platforms are strengthening categories beyond food delivery, intensifying competition and innovation:

• In 2025, Rabbit, a leading quick-commerce player, announced its market entry into Saudi Arabia, reinforcing the sector’s economic potential.

• Homegrown platform Doos, launched in 2023, secured a strategic investment from Jahez to expand cloud stores across Riyadh and Jeddah, diversifying into essentials, fresh produce, and lifestyle categories.

These developments reflect heightened competitive activity and underscore the strategic importance of quick commerce as a growth lever within the broader hyperlocal ecosystem.

E-Commerce Momentum Strengthens the Quick-Commerce Vision -

E-commerce has emerged as the second-largest venture capital-funded sector in the Kingdom, a testament to national digital transformation priorities. As per government sources, e-commerce revenues reached approx. SAR 211 billion in 2024, reflecting widespread adoption of online retail.

Strategic enablement programs, including the E-Commerce Incentive Program and the Financial Sector Development Program (backed by SAMA), are unlocking digital merchant growth and strengthening consumer trust in online payments.

Makreo Research highlights that as Saudi retail scales, the hyperlocal retail market alone is projected to reach USD 13.5 billion (SAR 50 billion) by 2030, comprising ~2% of the Kingdom’s non-oil GDP.

Saudi Retail Expansion Fuels Hyperlocal Demand -

Saudi Arabia’s retail market is projected to undergo significant expansion through 2030, with the hyperlocal retail segment emerging as a key economic driver. Makreo Research forecasts the hyperlocal retail market to reach approximately USD 13.5 billion (SAR 50 billion), contributing nearly 2% of the Kingdom’s non-oil GDP by the end of the decade.

This expansion is tightly interlinked with logistics demand:

• Roughly 40% of Saudi Arabia’s logistics requirements stem from wholesale and retail trade sectors, reinforcing the vital role of efficient consumer goods distribution in supporting the hyperlocal value chain.

As retail and wholesale volumes grow, expectations for fast, localized logistics have heightened, giving rise to opportunities for delivery providers to innovate and serve time-sensitive, last-mile consumer needs across both urban and emerging markets.

Saudi Arabia Hyperlocal Rural Expansion -

A notable trend in 2025 has been the expansion of rural delivery coverage. Supported by rapid advancements in last-mile delivery technologies and network optimization:

• Rural delivery coverage in Saudi Arabia expanded by 21%, bringing hyperlocal services to semi-urban and previously underserved regions.

This broader reach not only enhances consumer access to immediate delivery services but also reinforces national digital inclusion initiatives, bridging geographic divides and creating new demand corridors for hyperlocal providers.

Saudi Arabia Hyperlocal Tech-Led Unicorn Growth and Rising IPO Ambitions -

Saudi Arabia’s homegrown delivery and logistics innovators are gaining global attention:

• Ninja, a young tech-driven hyperlocal delivery platform, achieved unicorn status in July 2025, following a USD 250 million funding round led by Riyad Capital. This investment valued Ninja at around USD 1.5 billion, making it one of the Kingdom’s most prominent tech success stories.

• Building on this momentum, Ninja is reportedly engaging investment banks to explore a potential initial public offering (IPO) as early as 2026, with discussions indicating that the listing could extend into 2027 depending on market conditions and advisory guidance.

These developments underscore the strategic maturation of Saudi Arabia’s hyperlocal ecosystem, from nascent service offerings to scalable, globally competitive enterprises.

The Next Phase of Hyperlocal Growth in Saudi Arabia -

Saudi Arabia’s hyperlocal delivery industry is advancing through a fundamental shift in consumption habits, guided by rapid digital integration, convenience-driven demand, and omni-channel retail expansion.

Key structural shifts include:

• Food delivery maintaining a dominant 75% share of the hyperlocal market in 2025

• Night-time delivery orders rising by 50% during Ramadan

• Retail and wholesale trade contributing ~40% of logistics demand, strengthening last-mile dependency

• Rural delivery coverage expanding 21% in 2025, unlocking underserved markets

Strategic Opportunities and Future Outlook -

As the market transitions beyond food delivery into quick-commerce essentials, lifestyle categories, and express retail fulfillment, significant growth catalysts are emerging:

• Cloud-store networks deepening accessibility across metropolitan and semi-urban cities

• Investments fuelling faster scaling and unicorn emergence in logistics tech

• Government-backed digital commerce programs elevating national competitiveness

• Strong venture capital momentum accelerating innovations in last-mile efficiency

Makreo Research’s latest study reveals that the Saudi Arabia Hyperlocal Delivery Market is entering a multi-dimensional growth phase, backed by detailed market sizing, segmentation analysis, competitive benchmarking, and growth forecasts through 2030, as consumer convenience, digital commerce, and smart logistics converge to unlock expansive opportunities across urban and emerging regions.

Related Reports:

Saudi Arabia Warehousing and Cold Storage Market (2019-2030)

For tailored insights or specific inquiries, explore our comprehensive Logistics and Warehousing and Last-Mile Delivery Reports

Saurabh Adsule

Makreo Research and Consulting

+91 96196 99069

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.